How sustainability will drive growth in the packaging industry

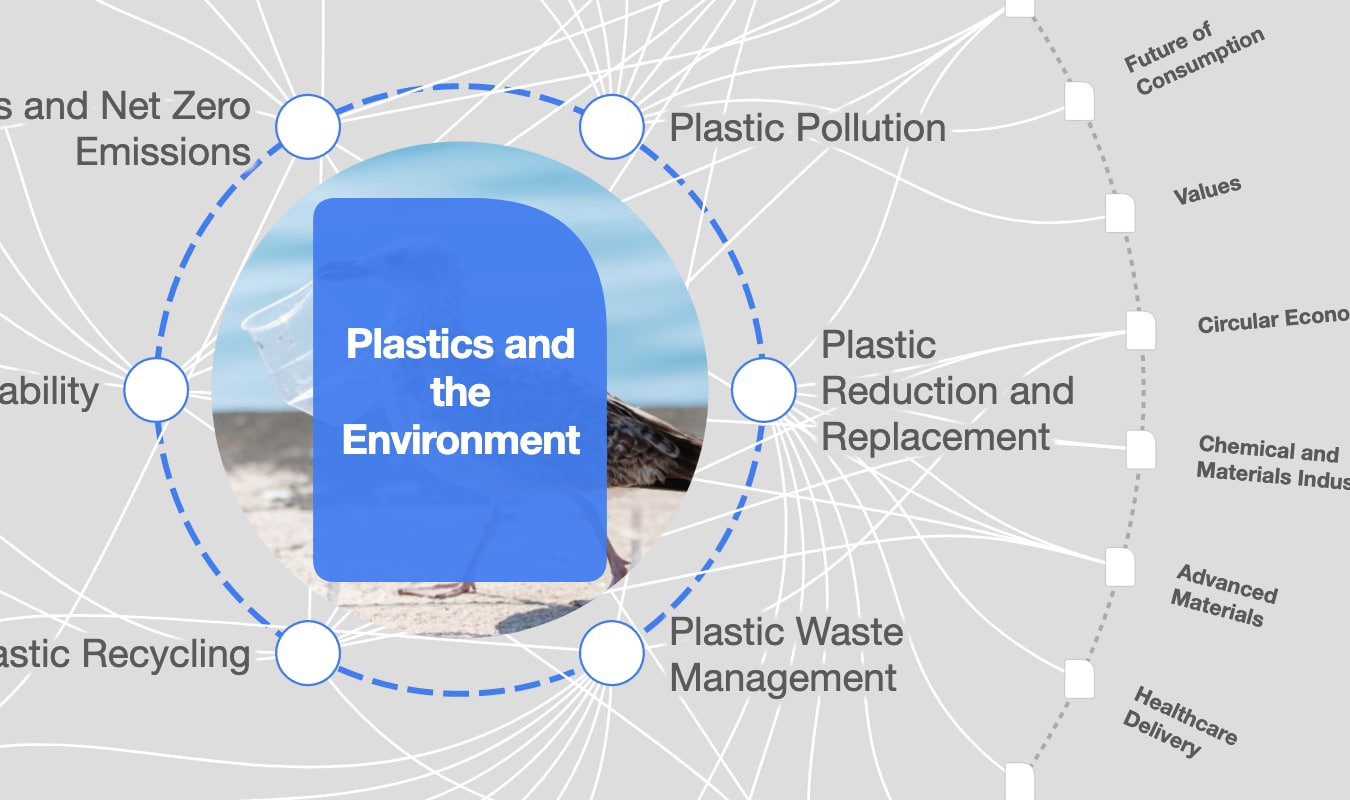

PET bottles are widely collected and can be recycled into new bottles or textiles. Image: REUTERS/Arnd Wiegmann

- The recyclable properties of PET will drive growth in the packaging sector.

- Brands are including more and more recycled content in their packaging to meet consumer demands.

- The Global Plastic Action Partnership is bringing decision-makers together to forge collective solutions.

Across the world people are learning that not all plastics packaging is the same. A unique type of recyclable plastic called Polyethylene Terephthalate – or PET – is commonly used for soft drink and water bottles. Today PET bottles are the most recycled plastic packaging in the world. This is set to increase as the world adopts a shared responsibility to end plastic waste. The coming decade will see collection of post-consumer beverage bottles reach close to 100%. Recycling is critical to our sustainable future as it delivers fewer greenhouse gases and less waste.

As the world’s largest manufacturer of PET packaging, we at Indorama Ventures have a responsibility to improve the sustainability of our sector. We also believe that the recyclable properties of PET will drive growth in our sector. The reasons for this are as clear as the bottles themselves:

1. Consumers want sustainable and recyclable packaging.

2. PET bottles are widely collected and can be recycled into new bottles or textiles.

3. Many governments plan to collect 90% of post-consumer PET bottles.

4. Global brands have targets to increase recycled content in beverage packaging.

This social, political and commercial focus on recyclability is an opportunity to increase recycling investments and have a positive impact on global circular economy initiatives.

Brands are including more and more recycled content in their packaging to meet consumer demands. Global names like Cola-Cola, PepsiCo, Unilever, Danone and Nestle have all made ambitious commitments to include up to 100% recycled plastics in their packaging. They recognize the value of PET, not just from an economical view, but also from a holistic sustainability standpoint.

The old saying goes, “Don’t tell me about your commitments. Show me your budget and I’ll tell you them!” In 2019, we pledged $1.5 billion to increase recycled content volumes by at least 750,000 tonnes by 2025. To put this in context, in March this year we recycled our 50 billionth PET bottle since we started in 2011. Our investment will see us recycle 50 billion bottles per year by 2025. To do this, we are building the infrastructure the world needs to close the loop and deliver a circular economy for PET packaging.

Our commitment remained steadfast through the uncertainty and challenges of the global pandemic as we acquired assets in Brazil and Poland, joining a family of recycling facilities in Europe, the Americas and Asia.

Investment like ours is becoming more common. According to the Climate Bonds Initiative, investors with $45 trillion of assets under management have made public commitments to climate and responsible investment. What separates these investors from their predecessors, is the specified use of the proceeds. Investors are increasingly focused on integrating Environment, Social and Governance (ESG) factors into their portfolio.

Major investment is needed to transform the global economy to deliver on climate, environmental and social sustainability goals, including the Paris Agreement and the UN Sustainable Development Goals. For example, the European Commission says Europe needs between €175 and €290 billion in additional yearly investment in the next decades, to meet their commitment to make the EU climate-neutral by 2050. In the future, sustainable businesses will be the investment of choice for the mainstream investment community.

But the collective will and financial supports for a closed loop, circular economy face regulatory roadblocks. Major countries have not allowed for bottle-to-bottle recycling due to gaps in their food contact material regulations. In developing nations, waste collection can be unregulated, ad-hoc or totally inadequate. These are challenges that required a partnership approach to deliver real results.

What is the World Economic Forum doing about plastic pollution?

This is why we are proud to join the Global Plastic Action Partnership (GPAP) at the World Economic Forum. By joining we will advance our shared goal of ending plastic waste. GPAP is making this happen by bringing decision-makers together to forge collective solutions. The linear economy of the past was about “‘take-use-dispose’”. The circular economy of the future is about “use, collect, recycle”. This can be a growth driver for business. The GPAP community is championing this shift to a circular economy and helping the world to understand the benefits of a closed-loop approach.

For our part we will continue to invest in recycling infrastructure. We are proud to have secured Thailand’s first-ever green loan, for $100 million and €100 million, from Japan’s Mizuho Bank. This has been increased to $200 million and €200 million, with a reduction in cost of financing, recognizing our improved environment, social and governance rating.

In the past, many thought of sustainability as a cost. We at Indorama Ventures embrace sustainability. We see it as a transformative journey that demands we continually improve our operation and our team. We are confident that together, we will succeed in achieving our sustainability objectives in the decade ahead. Ultimately, sustainability will drive our long-term success.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Plastic Pollution

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Forum in FocusSee all

Gayle Markovitz

October 29, 2025