This is how much house prices have increased in countries around the world

Birdseye view of a residential area in the UK, which would have seen rises in house prices recently. Image: Richard Horne/Unsplash

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

SDG 08: Decent Work and Economic Growth

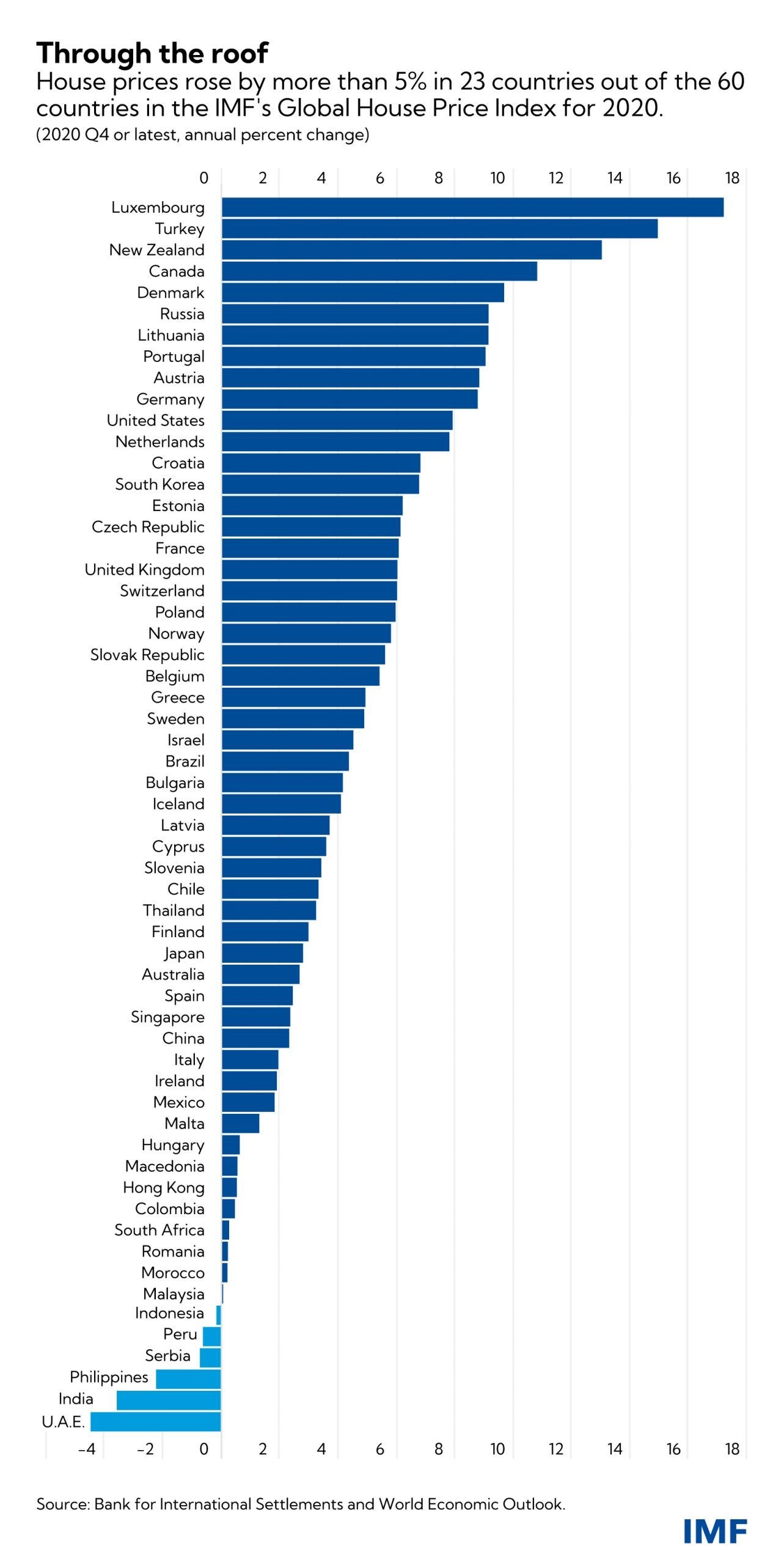

- The majority of countries in the IMF's Global House Price Index saw a rise in house prices over the pandemic.

- Low interest rates and high demand are just a couple of reasons why house prices have risen.

- This increase in house prices has made housing unaffordable for many segments in Europe.

While most economic indicators deteriorated last year, house prices largely shrugged off the effects of the pandemic. Of the over 60 countries that enter into the IMF’s Global House Price Index, three-quarters saw increases in house prices during 2020, and this trend has largely continued in countries with more recent data.

IMF research indicates that low interest rates contributed to the boom in house prices, as did policy support provided by governments and workers’ greater need to be able to work from home. In many countries, including the United States, online searches for homes reached record levels. Along with these demand factors, house prices also increased as supply chain disruptions raised the costs of several inputs into the construction process.

How has the Forum navigated the global response to COVID-19?

While fundamentals of demand and supply can account for much of the buoyancy of housing markets during the pandemic, policymakers are nonetheless keeping a close watch on developments in this sector. The increases in house prices relative to incomes makes housing unaffordable to many segments of the population, as highlighted in the IMF’s recent study of housing affordability in Europe. The post-pandemic working arrangements could also exacerbate inequality concerns as high-earners in tele-workable jobs bid for larger homes, making homes less affordable for less affluent residents. The surge in house prices has also had an impact on headline inflation in some countries and could contribute to more persistent inflationary pressures.

Over a decade ago, a turnaround in house prices marked the onset of the Global Financial Crisis. However, the twin booms in household credit and house prices in many countries before that crisis—and many previous housing crashes—appear less prevalent today. Hence, in a plausible scenario, a rise in interest rates, a withdrawal of policy support as economies start to recover, and a restoration of the timely supply of building materials, could lead to some normalization in house prices.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Global CooperationSee all

Kiriko Honda

April 25, 2024

Lasse Jonasson

April 24, 2024

Tunde Kara

April 24, 2024

Ella Yutong Lin and Kate Whiting

April 23, 2024

Spencer Feingold and Kate Whiting

April 23, 2024

Robin Pomeroy and Sophia Akram

April 22, 2024