Tariff shock, protectionism and the rise of the Global South: The top international trade stories of 2025

The year saw global trade reshaped by tariffs and fragmentation. Image: REUTERS/Carlos Barria/File Photo

Sean Doherty

Head, International Trade and Investment; Member of the Executive Committee, World Economic Forum- 2025 has brought both political friction and economic reinvention for the global trading system.

- From tariff shocks to South-South trade gains and climate-linked supply chain shifts, here are the must-read stories from the past 12 months.

2025 was a year of profound contradiction. The return of aggressive protectionism and "tariff turmoil" dominated the headlines in the wake of the 2024 US election. Yet the global trading system proved remarkably resilient, according to UNCTAD, defying expectations to reach a record $35 trillion in value.

Beneath this headline number, the engine of growth has changed. As traditional corridors faced new friction, 'middle powers' in the Global South accelerated their own connectivity; meanwhile, climate policy increasingly leans on trade policy.

From the halls of Davos to COP30 negotiations in Brazil, here are the must-read stories, reports and data charting a turbulent year.

1. Navigating tariffs and a fragmented global trade landscape

Amid shifting political winds and escalating trade disputes, 2025 brought a new phase of tariff uncertainty that reshaped the global trading landscape. The Forum tracked this evolution from the initial "vibe shift" at Davos in January 2025, where an expert panel discussed the implications of a second Trump term, to the rollout of new US goods tariffs later in the year.

For more details, explore the evolution of the US "reciprocal" tariffs and other trade developments in this series of infographics. The tariff rates, some of which have been adjusted, targeted a broad range of allies and emerging markets.

Throughout the year, the Forum and its partners explored how businesses can best navigate the mounting friction and trade fragmentation. This article, for example, outlined five strategies for bolstering resilience:

- Enhance supply chain visibility: use digital tools to map suppliers beyond Tier 1, identifying hidden exposure to tariff spikes.

- Engage in scenario planning: move beyond historical data to stress-test operations against multiple geopolitical outcomes.

- Diversify supply sources: reduce reliance on single-source regions to mitigate the risk of sudden trade barriers.

- Invest in cyber resilience: treat digital infrastructure as a core trade asset that requires robust defence and insurance.

- Advocate for trade agreements: push for regional deals that can serve as buffers against global fragmentation.

Dive deeper:

Europe's path: How the EU negotiated a separate deal, and what it means for European competitiveness.

US-China relations: Tracking tariffs: Key moments in the US-China trade dispute.

2. Climate policy needs trade policy

By the time leaders gathered in Belém, Brazil, for COP30 in November, it was widely recognized the green transition leans heavily on supply chains. Throughout the year, reports and events unpacked the specific choke points that would define negotiations: from the "embedded emissions" challenge to the friction caused by resource competition, a key topic at this year's Annual Meetings of the Global Future Councils and Cybersecurity in Dubai.

As demand for grid infrastructure peaked ahead of the summit, one analysis asked: What happens if the copper market is hit with tariffs? Technology remains the bridge. Meanwhile, insights on batteries and green molecules highlighted "pieces of the decarbonization puzzle".

For more on the mechanics behind these policy shifts, listen to the podcast below exploring embedded emissions and global trade's potential role in reducing them:

3. AI, cyber resilience and TradeTech

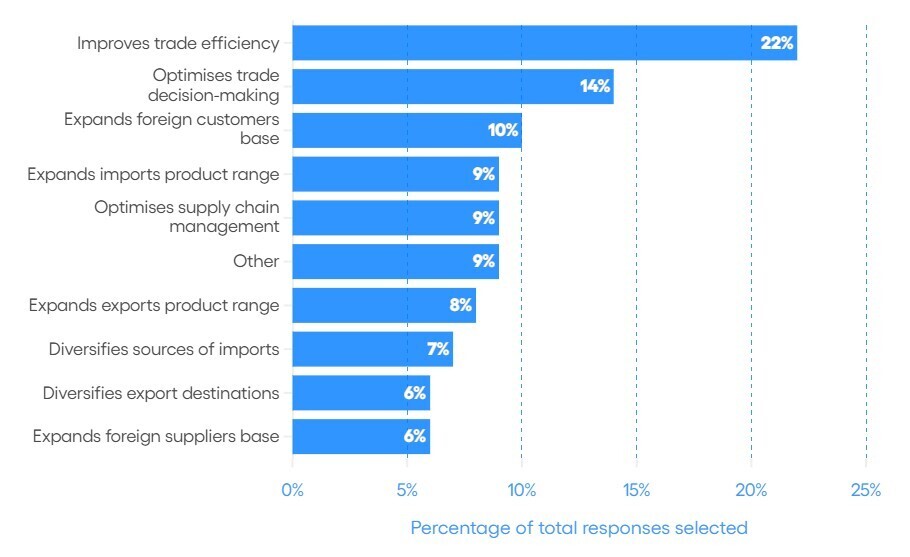

As physical borders hardened, the race for digital efficiency accelerated. The 2025 TradeTech Forum in April highlighted how AI can reduce compliance costs by automating the complex customs procedures required in a high-tariff world.

This shift is already visible on the ground. A December report from the International Chamber of Commerce found that nearly 50% of firms have now adopted AI for trade-related activities, with some reporting cost reductions of up to 50% – validating the technology as a critical survival tool.

But digitalization brings its own risks. New research explored the 'darker side' of connectivity, asking: How will a global trade war shape the future of cyber leadership? Despite these threats, IDB Lab's Sergio Navajas and Forum TradeTech lead Jimena Sotelo argued that fintech is proving secure, tech-enabled solutions can finally solve the historic headache of cross-border payments for small businesses.

4. Strategic autonomy: The rise of ASEAN and Africa

As economic ties between the US and China shifted and global trade patterns increasingly aligned with geopolitical relationships – a trend reflected in UNCTAD’s end-of-year data showing a rise in ‘friendshoring’ – middle-power economies intensified their efforts to build resilience.

Nowhere was this more clear than in Southeast Asia. Evolving beyond its traditional role as a manufacturing hub, ASEAN launched a "game-changing" Digital Economy Framework Agreement in May, designed to unlock $2 trillion in value by 2030.

In Africa, the focus was on connection. With the expiration of AGOA – the US preferential trade deal that defined the last 25 years – the continent accelerated its pivot towards the African Continental Free Trade Area (AfCFTA). Shared digital infrastructure is now the critical rail needed to turn this legislative agreement into a functioning unified market.

For a deeper dive into regional dynamics, read more on ASEAN's economic reinvention here, and why West Africa must become a global trade powerhouse to fully leverage this shift in this analysis.

5. Indigenous trade: A new pillar of inclusion

Another interest for the Forum in 2025 was improving Indigenous trade outcomes, moving the issue from theoretical discussion to actionable policy.

Indigenous Peoples steward 80% of the world's remaining biodiversity, according to the World Bank. This means that global efforts to build sustainable, nature-positive supply chains depend on integrating Indigenous businesses into the trading system.

Anchored by the International Day of the World's Indigenous Peoples, on 9 August, the Forum released a comprehensive framework for governments, offering pathways – from procurement policies to IP protections – to integrate Indigenous businesses into global value chains:

- Trade agreements: including Indigenous-specific provisions to recognize unique economic rights.

- Policymaking: ensuring Indigenous communities are directly represented in trade decision-making.

- Promotion and facilitation: removing bureaucratic barriers that disproportionately disadvantage Indigenous exporters.

- Financing: providing targeted grants and low-interest loans to bridge the capital gap.

- National legislation: strengthening intellectual property laws to protect traditional knowledge and products.

It was followed by a second framework in November, focusing on Business and Indigenous-Led Practices.

Watch the video below to see how Indigenous leaders and IPETCA – an initiative supporting Indigenous trade and economic empowerment – are reshaping trade:

6. Resilience in humanitarian supply chains

Trade is often measured in GDP, but for the 305 million people around the world currently in need of aid, it is a matter of survival.

Celebrating its 20th anniversary, the Logistics Emergency Team marked a shift in how we view these lifelines. The focus has moved to readying humanitarian supply chains before disasters strike. By pre-positioning stock and sharing data early, the private sector is helping to keep aid flowing.

7. Global outlook: A record year with caution ahead

Recent data suggests the global trading system isn't breaking; it is rewiring.

Despite the tariff shocks and fragmentation of 2025, UNCTAD reports that global trade is set to reach a record $35 trillion this year – a 7% increase that adds $2.2 trillion to the global economy. Crucially, this growth wasn't driven by traditional heavyweights, but by the rising economies of the Global South.

East Asia, Africa and South-South trade were the strongest drivers of global gains... South-South trade expanded around 8%, reflecting deepening economic ties among developing economies.

”This suggests that commerce is surviving the "fracture" by finding new routes. However, the outlook for 2026 demands caution. The report warns that this resilience comes with a price tag: rising debt, higher shipping costs and the inefficiencies of friendshoring are likely to weigh on momentum in the year ahead.

Yet, if 2025 proved anything, it is that the global trading system is far more adaptable than predicted – setting the stage for another year of reinvention.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Contents

1. Navigating tariffs and a fragmented global trade landscape2. Climate policy needs trade policy3. AI, cyber resilience and TradeTech4. Strategic autonomy: The rise of ASEAN and Africa5. Indigenous trade: A new pillar of inclusion6. Resilience in humanitarian supply chains7. Global outlook: A record year with caution aheadForum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.