The business case for investing in sustainable plastics

Financial institutions can play a big role in promoting more sustainable plastics Image: REUTERS/Mohammad Ponir Hossain

- Plastics reduction and climate change are sustainable investors' top priorities.

- Solutions to plastic waste must come from all sectors.

- Financial institutions have a unique vantage point from which to address this issue.

The World Economic Forum's Global Plastic Action Partnership sat down with Audrey Choi, Chief Sustainability Officer and CEO of the Institute for Sustainable Investing at Morgan Stanley, to discuss the role financial institutions can play in tackling plastic waste.

What is ‘sustainable finance’? How is it different from ‘business as usual’?

We define sustainable investing as taking traditional investment practices and strategies and enhancing them with additional insights gained from considering environmental, social and governance (ESG) factors. We believe this can provide added insights into risks that could affect investments, as well as provide unique opportunities for investors.

Morgan Stanley’s Institute for Sustainable Investing has been polling investors since 2015 on their thoughts and attitudes around ESG. Over that time, investor interest in sustainable investing has grown from 71% in 2015, to 75% in 2017, and jumped to 85% among US investors last year. Investors have also told us they believe their investment decisions can impact the issues they care about most, with 84% wanting products that will allow them to match their investment choices with their values, and 86% saying that they believe ESG practices may potentially lead to better profitability and may be better long-term investments.

How UpLink is helping to find innovations to solve challenges like this

When we asked investors last year about which areas of ESG they were most passionate, climate change and plastic reduction topped their list. In 2018, the number of earnings calls that included mentions of “plastic waste” increased 340% year over year. Matching this growth in interest, the amount of assets allocated towards sustainable investing has also grown; in the US, $3 trillion was allocated to sustainable investments in 2009, and by 2018, this had quadrupled to $12 trillion. Globally, one in every three dollars is now focused on sustainable assets, topping $30 trillion — up 34% over the previous two years. More recently, green bonds have experienced significant growth — from $2.6 billion in 2012 to more than $200 billion in 2019.

One obstacle to sustainable investing is the myth that doing so means sacrificing returns. In fact, our own analysis of 11,000 mutual and exchange-traded funds over 15 years finds that sustainable funds do not deliver lower returns – but they may offer lower downside risk. They exhibit less volatility, and on average, the downside deviation of sustainable funds is 20% smaller than traditional funds.

I believe sustainable investing will continue to accelerate and attract more assets as investors increasingly recognize the value of ESG data, driving the full integration of sustainable investing into mainstream investing.

You’ve pledged to prevent, reduce and remove 50 million metric tons of plastic waste from the environment by 2030. How will you achieve this?

In April 2019, we made a major firm-wide commitment, the Morgan Stanley Plastic Waste Resolution, to facilitate the prevention, reduction and removal of 50 million metric tons of plastic waste from rivers, oceans, landscapes and landfills by 2030. We believe that tackling the plastic waste problem will take a systemic and holistic approach across the economy that considers everything from materials engineering and industrial design to consumer use and recycling infrastructure. It will require cross-sector collaboration from governments, philanthropy, industry, finance and individuals.

To meet this goal, we are leveraging all of Morgan Stanley’s businesses and our operations to reduce plastic waste by developing new investment products, underwriting bonds to help reduce plastic waste and offering low-minimum portfolios to positively influence the UN’s Sustainable Development Goal on ocean conservation while we continue to work with municipalities, public agencies, universities, hospital systems and other public and not-for-profit entities to finance improvements to collection, recycling and disposal systems for plastic waste.

We hope that our pledge inspires other businesses and financial institutions, and so far we’ve seen some really amazing progress. In April, we underwrote a $10 million World Bank blue bond with proceeds focused on plastic waste reduction in oceans and the promotion of marine resources. Just six months later, we were the sole green structuring advisor and lead underwriter for PepsiCo’s $1 billion inaugural green bond offering that focused on key initiatives around PepsiCo's sustainability agenda, including their commitment to reduce the virgin plastic content across their beverage portfolio by 35% by 2025.

What role can – and should – financial institutions play in accelerating action on plastic pollution?

We’ve always believed that solutions at scale have to come from across the plastics value chain because no one company, industry sector or individual alone can clear away the billions of metric tons of plastic waste already in our environment or curb the ever-increasing amount of new plastic waste that is generated daily. Currently 79% of all the plastic waste ever produced remains with us. Plastic packaging worth up to $120 billion per year is used once and then thrown away. This is an enormous waste of resources.

As a global financial institution, we believe that we have a unique vantage point from which to work with the different actors who need to be a part of plastic waste solutions. We can also connect investors seeking to align their portfolios with plastic waste reduction to the entrepreneurs and corporations focusing on creating less plastic waste. By bridging these investors and companies, we believe we can contribute to the systems change we need to retain the beneficial qualities of plastic in the economy, while reducing the environmental downside of plastic waste.

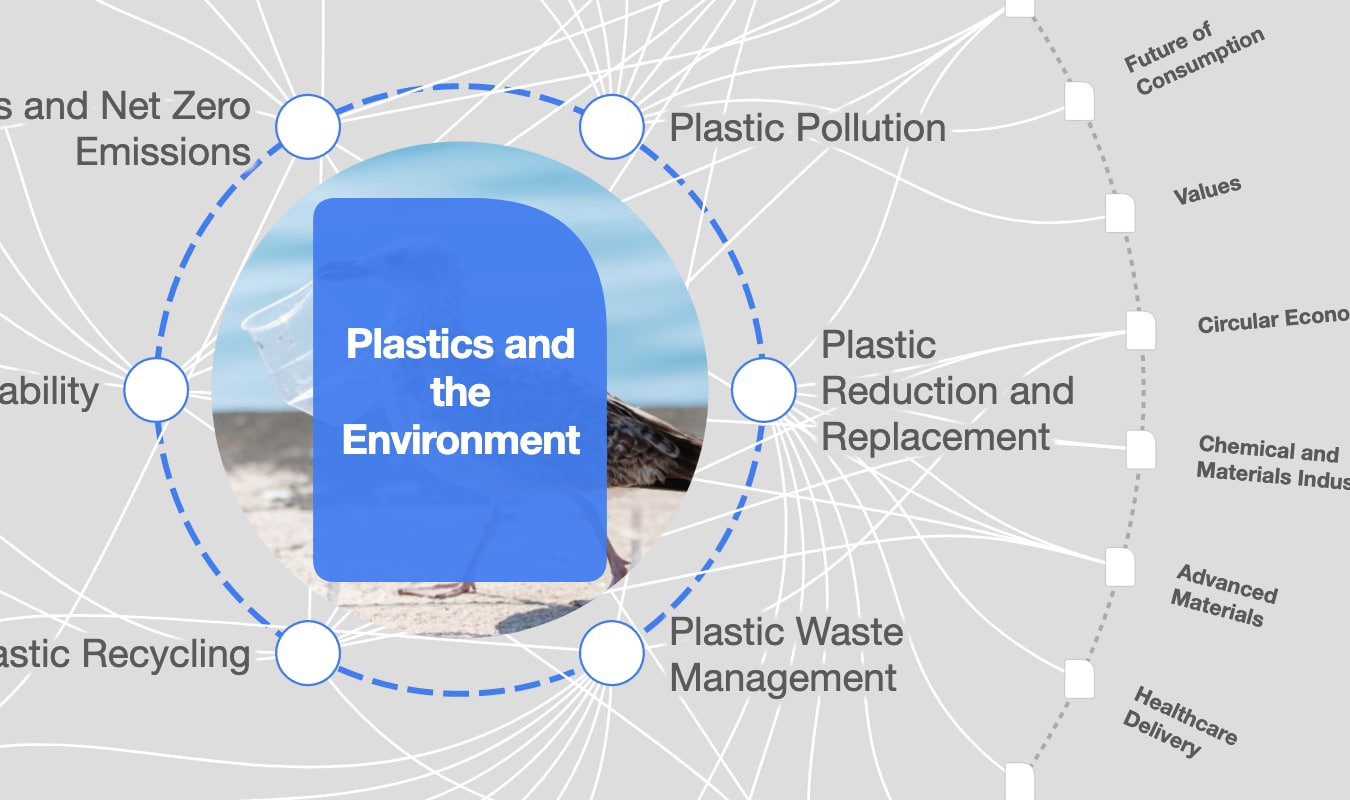

What is the World Economic Forum doing about plastic pollution?

What opportunities do you see to work with other actors on plastic pollution, especially stakeholders from other sectors?

We’re very excited to collaborate with academic institutions and nonprofits to support research and thought leadership that will enable us to better understand the challenges around, and solutions to, plastic waste. As part of our Plastic Waste Resolution, we founded the Plastic Waste Reduction Fellowship with the University of Michigan School for Environment and Sustainability to explore how markets and investment can help reduce plastic waste and identify the drivers of plastics flows in the global economy. In partnership with Northwestern University’s Kellogg School of Business, we also created a new plastic waste reduction award in our Kellogg-Morgan Stanley Sustainable Investing Challenge specifically to catalyze innovative investment strategies around reducing plastic waste.

In November, we partnered with National Geographic Society and the University of Georgia College of Engineering on the Marine Debris Tracker – a mobile app that enables individuals to log plastic waste pollution along coastlines and in waterways. This is a first-of-its-kind open-data platform with over two million items tracked to-date, and the partnership is helping improve our understanding of the sources of plastic debris and pollution while also generating scientific findings.

We have also recently joined the Global Plastic Action Partnership, a public-private platform hosted at the World Economic Forum, as one of its inaugural community leaders. In this role, we look forward to not only contributing our knowledge and expertise towards combatting plastic pollution, but to learning from others about where we can create the biggest impact.

By collaborating with academia and non-profits, as well as industry and individuals, we can help ensure our plastic waste reduction solutions are both financially and environmentally sustainable over the long term.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Plastic Pollution

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Forum in FocusSee all

Gayle Markovitz

October 29, 2025