How companies can play both offense and defense in the carbon race

Answering four basic questions can set businesses up for success in the energy transition. Image: REUTERS/Phil Noble

Torsten Lichtenau

Senior Partner; Global Practice Leader, Carbon Transition Impact Area Practice, Bain & Company

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

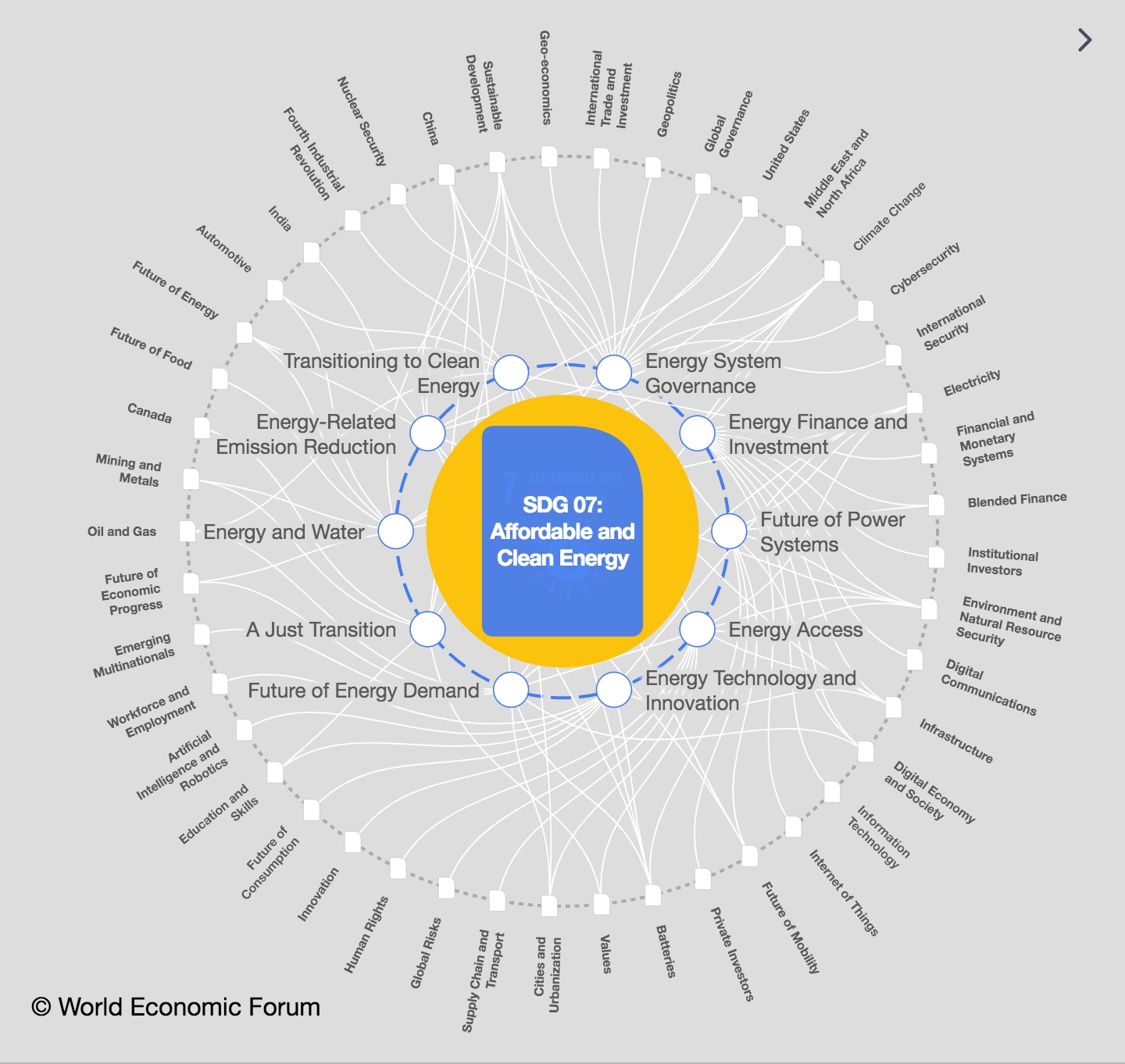

SDG 07: Affordable and Clean Energy

- Business has a critical role to play in the race to decarbonise.

- Companies leading the energy transition play both defense and offense, defending themselves and mitigating risks as well as taking proactive steps to create new value.

- Answering four basic questions can set businesses up for success.

As fires ravaged parts of the US, Turkey and Greece, and as historic floods swept through Belgium and Germany, the UN Intergovernmental Panel on Climate Change (IPCC) released a harrowing warning: even if nations sharply cut emissions today, the global temperature is still likely to rise around 1.5 degrees Celsius over the next two decades. This dire report came on the heels of an announcement by the International Energy Association (IEA) that the economic recovery from the COVID-19 pandemic is pushing up global carbon emissions to 1.5 billion tons this year.

The tragic evidence and indisputable warnings are forcing companies to focus on the critical role they play in the race to decarbonise and the urgent need to intensify their efforts. Most executives acknowledge that it is essential not only to put decarbonisation at the top of the corporate agenda, but also to deliver on bolder commitments. Many have already expanded their emphasis from lowering Scope 1 and 2 emissions (those they generate themselves) to include Scope 3 (the harder-to-control emissions from their supply chain and consumers of their goods).

Two guiding principles for decarbonisation

Generally, companies leading the carbon transition follow two guiding principles:

1. They simultaneously play defense and offense.

2. They view decarbonisation as a way to accelerate a full-potential transformation.

Many companies begin their decarbonisation efforts as a way of defending themselves, often by preparing for reporting requirements or anticipating shareholder expectations. They also consider how they will mitigate potential physical risks. Mining and agriculture companies, for instance, need to anticipate how water scarcity, flooding and rising temperatures linked to climate change will hurt productivity. Playing defense also means preparing for the issue of stranded assets.

Carbon transition, however, represents as much upside opportunity as downside risk. Companies are playing offense by taking proactive steps to create new value. Take Bosch, for example. Beyond achieving carbon neutrality, the company is developing new products and services to help other companies decarbonise, too.

Embracing the need for a full strategy overhaul is the second guiding principle. Last year, in a Bain & Company survey of 80 business leaders in oil and gas, utilities, new energy, chemicals, agribusiness, mining and minerals services, and financial markets, 60% said an energy or resource transition was central to the future of their sector, and 35% are starting to change their priorities and create opportunities. Those leaders acknowledge the climate imperative requires a full-potential transformation that touches every part of the organisation.

What is the World Economic Forum’s Sustainable Development Impact summit?

Companies pursue three types of transformations. Some, such as Unilever, have evolved their core business toward sustainability. Others have added a second core. Finland’s Neste has become the world’s biggest producer of renewable diesel, alongside its traditional oil business, dropping the word “oil” from its name in the process. And others have changed their core entirely. Denmark’s Ørsted used the carbon challenge as an opportunity to develop a market for offshore wind.

4 questions to answer if you want to decarbonise

As they pursue their carbon transition, companies must answer four big questions:

1. Is there sustained, visible leadership commitment combined with aligned incentives?

Even the best corporate intentions won’t succeed without commitment and direction from the CEO. Top leadership needs to back external commitments with action, integrating decarbonisation into ongoing organisational dialogue. The company needs to ensure incentives are aligned to decarbonisation results and cascade broadly throughout the organization. Such incentives connected to carbon objectives were key to Bosch’s ability to deliver carbon-neutral operations in 2020.

2. Is there a bankable plan owned by line management, with ruthless prioritisation across sites?

Companies that achieve the best results translate their decarbonisation ambition into operational plan targets that are owned by line management, prioritising initiatives that optimize value throughout the decarbonisation journey and result in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) uplift. For example, chemical holding company Indorama set aggressive site-by-site EBITDA targets that kept it on track for accelerating emissions reduction.

3. Is the organisation set up to win, learn and scale in a systematic way?

Companies need to ensure the right operating model, people and technologies are in place to quickly scale decarbonisation efforts while strengthening the collective experience curve. Norway-based energy company Equinor, for example, reorganised in a way that will help the company better pursue renewable fuel alternatives and reduce emissions.

4. Are technology partners effectively used to accelerate change?

Decarbonisation leaders take a comprehensive approach to monitoring the evolving technology landscape while building out an ecosystem and integrated data platform. Consider how clients have teamed up with Paris-based data analytics company Kayrros to solve methane leakage detection by combining satellite monitoring, aerial surveillance and mobile sensors.

Have you read?

Companies that can affirmatively answer these four basic questions will set themselves up to play both offense and defense – and will emerge as leaders in the race to tackle the planet’s top business challenge.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Forum InstitutionalSee all

Spencer Feingold and Gayle Markovitz

April 19, 2024

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024