Rethinking global supply chains for the energy transition

Lessons learned during the development of global oil markets could be applied to growing markets for critical energy transition materials. Image: Unsplash / @ventiviews

David G. Victor

Professor, University of California, San Diego (UCSD), Nonresident Senior Fellow, Brookings Institution

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

- We need to rethink global supply chains in order to support the energy transition.

- There are lessons from the development of the global oil markets that can be applied to markets for critical energy transition materials such as lithium, cobalt and copper.

- Setting global standards and supporting innovation to boost supply diversity will help to eradicate potential choke points as global demand for these commodities continues to increase.

Alarm bells are ringing about the future of the energy transition. These bells are getting loudest just as the world contemplates shifting away from oil—the commodity for which dependence on foreign resources and vulnerable supply routes defined energy insecurity for more than a century.

Many of the same problems that affected global oil markets are already affecting the markets for critical energy transition materials such as lithium, cobalt, copper, and rare materials used to manufacture solar panels, batteries and other clean energy technologies. As with oil, the whole world depends on these materials, but geologically they are concentrated in just a few places.

While logic points to the need for bigger and more diverse suppliers, since the middle of 20th-century governments have often sought security by onshoring and tinkering with supply chains, or restricting import quantities. Neither approach has worked, and fragmenting markets in this way often undermines security.

Building a global market

The real solution comes from treating global commodities as a global market. Transparency of data, stockpiles in case of emergency, and coordination across major users (and, to some degree, suppliers) have made the oil markets a lot more robust. Similarly, it was globalization that helped drive down the cost of solar power technology. And where globalization has faltered, costs have risen and progress towards the energy transition has slowed.

The same can and should be done for the materials that are critical to the energy transition. For resources that are truly essential and inconveniently allocated around the globe — lithium is the leading example — we need the equivalent of joint market oversight and management.

Growing attention is being paid to the role of government policy in creating new markets and technologies. That same logic can apply to policy innovation that can help create new supplies for materials that are critical to the energy revolution such as polysilicon, for which supply is currently tight.

Another lesson from oil is that the biggest dangers of dependence on overseas suppliers hinge on the methods of production. If suppliers harm the environment or human rights, they harm everyone and undermine social justice for the sake of the energy transition. An especially pernicious problem is that vast revenues earned from mining can be channeled to nefarious purposes, including corruption.

"For resources that are truly essential and inconveniently allocated around the globe — lithium is the leading example — we need the equivalent of joint market oversight and management."

”Setting standards for markets

The solutions to these problems depend on the development of clear long-term standards by importers — the actors that are most motivated to develop remedies and that are in the strongest position to demand change. This means implementing extraterritorial pollution standards (e.g. carbon regulation and border adjustments) and red lines for intolerable activities such as human rights abuses.

When those standards are clear, markets can perform better. For example, western abhorrence to cobalt mining practices has put pressure on innovators to find ways to make clean energy batteries without cobalt.

Here, too, oil offers a lesson: data reporting systems such as the Extractive Industries Transparency Initiative (EITI) are having measurable impacts on how money from mineral supplies gets spent. EITI is not perfect, but marrying that programme with globalized commodity markets, rather than fragmented onshored systems, gives buyers more leverage. Other programmes are working with the same goal: more just, less corrupt markets built on greater transparency and oversight.

Innovating to boost diversity

The big difference between oil and the new mineral dependencies is the potential for radical, rapid innovation in supply and demand. For all the talk about moving past oil, by some measures the world’s dependence on oil hasn’t budged. This is because it is so hard to find cost effective and reliable alternatives even when there are strong incentives to switch. Innovations in supply such as shale oil have reinforced demand for the commodity, for example.

What's the World Economic Forum doing about the transition to clean energy?

When it comes to cobalt or lithium, however, if supplies run short or buyers get worried about poor production methods, recycling or switching to rival materials is an option. Innovation in mining can also turn abundant occurrences into reserves. The world is actually awash in lithium; today’s dependencies reflect the lack of much incentive to open mines in places where it is harder (but not impossible) to do business.

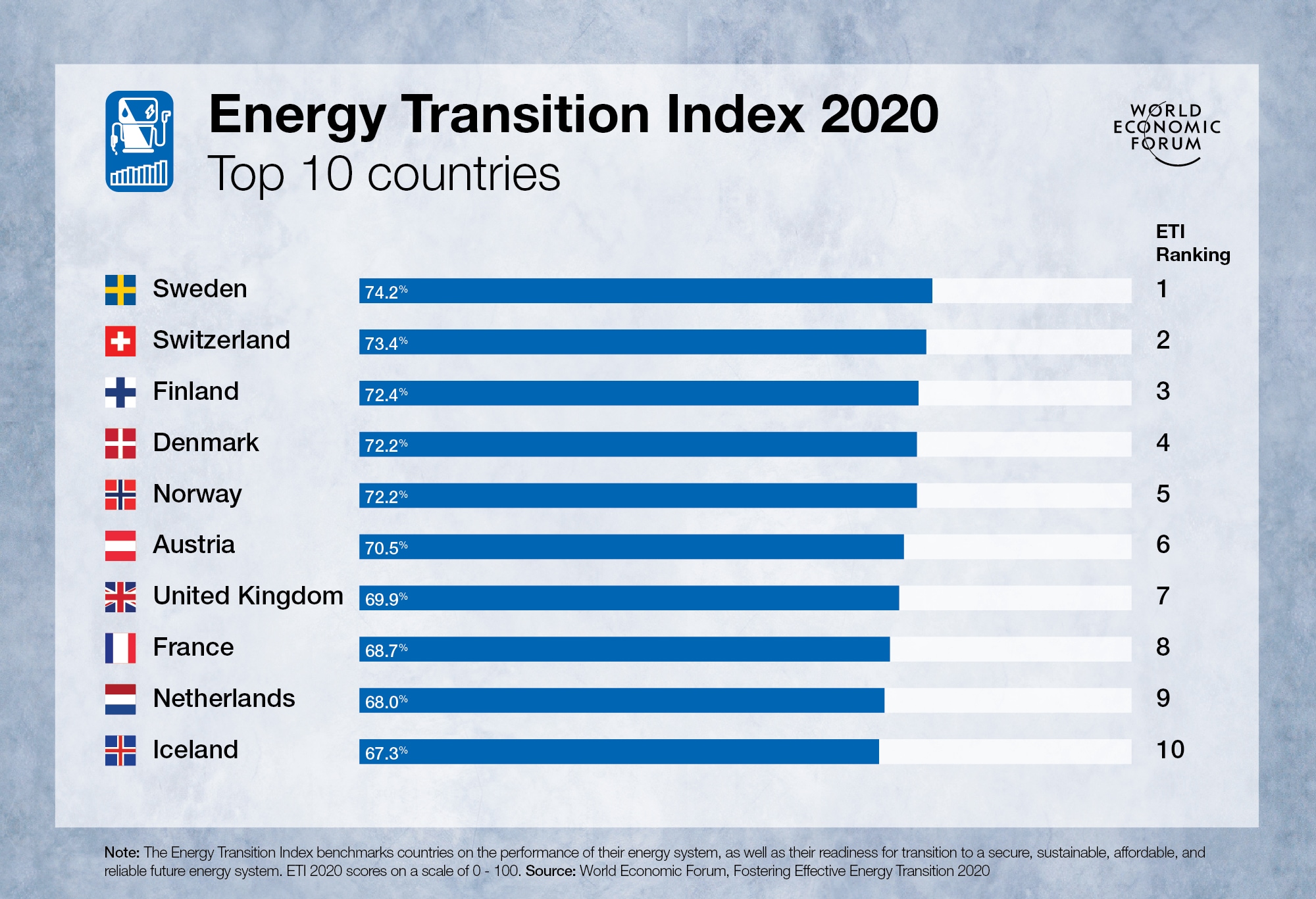

Rising prices for critical minerals are a powerful motivator for innovation, but cost must be kept in perspective. New research has shown that extraction of non-renewable mineral resources such as lithium and copper has risen by a factor of 6,000 since 1700. In the same period, global real GDP has increased by a factor of 190, while average per capita real GDP grew by a factor of 15. Prices have bounced around—better oil-like commodity management can dampen the most harmful price shocks—but stayed roughly flat (see figure 1).

Former British Prime Minister Winston Churchill said of oil security that the solution was diversity and diversity alone. The same is true today for lithium and other essential energy transition minerals. We must encourage supply diversity — more globalization, greater flexibility, production standards where essential and powerful incentives for innovation — for the materials that are truly critical to the energy transition.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Forum InstitutionalSee all

Spencer Feingold and Gayle Markovitz

April 19, 2024

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024