What is 'Phase Down Finance' and why it's better than divestment to achieve decarbonization

Phase Down Finance can assist in managing the socio-economic consequences of transition while ensuring Paris-aligned outcomes. Image: Reuters/Erol Dogrudogan

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Energy Transition

Listen to the article

- Divestment from emitting assets doesn't necessarily lead to their closure, leaving a gap in low carbon investment strategies.

- Phase Down Finance can assist in managing the socio-economic consequences of transition while ensuring Paris-aligned outcomes.

- Phase Down Finance also provides a mechanism for compensation of lost economic value under international climate finance regimes.

Climate science has honed in on 2050 as the date by which global carbon emissions need to achieve net-zero. By implication, we are now in a time of transition – a transition that requires rapid and far-reaching changes across our economy and society. But do we yet fully understand the role of finance in facilitating this transition?

It is clear that massive new investment in green infrastructure such as renewable energy, electric vehicles, and green hydrogen will be critical. Also, the International Energy Agency reports that all new investments in fossil fuel exploration must stop immediately if we are to meet the emissions targets required for a net-zero pathway.

However, an area that has thus far remained underexplored is how to deal with funds currently invested in existing fossil fuel assets. One approach is divestment: the withdrawal of funds from high-emitting assets to decrease the pool of funds available to fossil fuels, and limit climate risk exposure for investors.

Though divestment has been an important pressure in the financial system, there is little evidence that it directly results in the shuttering of emitting assets. More likely, the assets will be bought by investors with different climate obligations.

There are additional reasons why divestment may not be the solution. First is that it takes time to build out the replacement green infrastructure. Withdrawing financing for fossil fuel assets in the absence of adequate and affordable alternatives may have negative socio-economic consequences. Second, such assets are often publicly owned, meaning the state takes the loss if assets are closed before the end of their economic life. The coal-fired power plants of the South African state-owned utility, Eskom, provide over 80% of the country’s electricity. While the country has declared its intention to transition away from coal, it will take at least 15 years for sufficient replacement generation capacity to be built. Divestment would only result in state bailouts to keep the coal plant operational, and electricity price hikes. Both would impact the poor disproportionately if state funds were diverted from welfare programmes and low-income communities were forced to switch to alternative, dirtier and more dangerous forms of energy for cooking and heating.

The role of divestment is therefore limited to those instances where divesting the asset in question will actually result in its responsible phase-out, without negative unintended socio-economic outcomes.

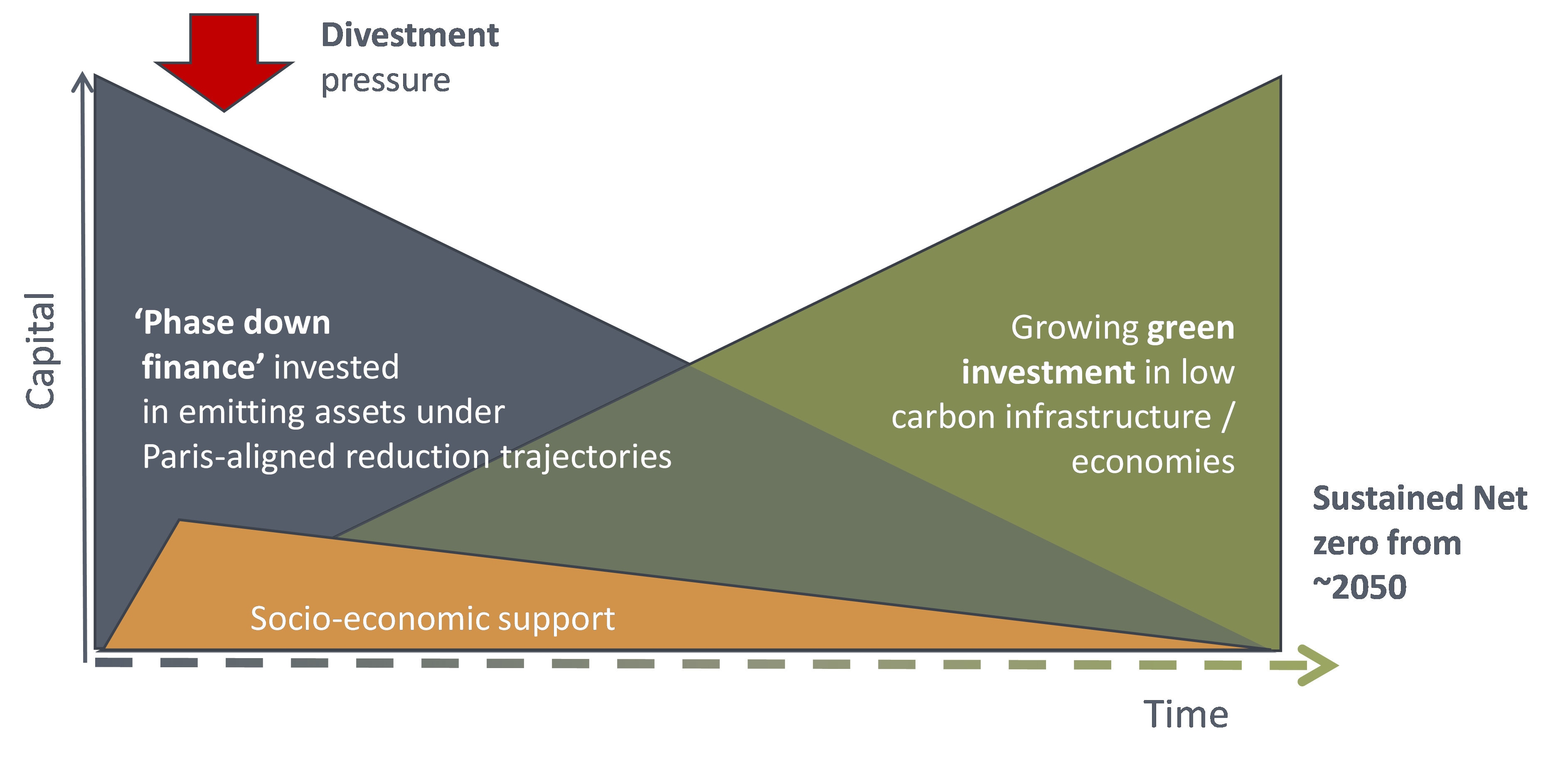

But if divestment isn’t the solution, what should investors do? Meridian Economics joins a growing number of voices calling for investors to remain invested, but only on conditions of responsible and Paris-aligned phase-down of emitting assets. We term this “Phase Down Finance”, and situate it, as per the figure below, against the broader financial needs of the global low-carbon transition that include divestment, green finance and socio-economic support for communities and economies in transition.

There are two core rationales to Phase Down Finance:

- Access to finance. While divestment removes access to finance, Phase Down Finance promotes access to finance but on strict terms. It can only be provided if the emitting assets adhere to pre-agreed Paris-aligned decarbonization trajectories. Emitting entities are therefore able to continue operating while green infrastructure is built.

- Compensation for lost economic value. The accelerated closure of emitting assets means that these assets are likely to be unable to recover their original investment. Phase Down Finance can compensate the entity for lost economic value in return for emissions reductions achieved by an earlier closure.

Phase Down Finance can include public and private sources of finance, market-related and concessional, at the project, programme and entity level, and will require the development of innovative financing solutions, modalities and bespoke instruments.

What's the World Economic Forum doing about the transition to clean energy?

In the South African case, the country has an urgent need for massive green power sector investment, a sustainable Eskom finance solution whilst it decarbonizes, and socio-economic support. Further, the country has a legitimate claim to concessional finance under the international climate finance architecture. While capital markets are likely to be able to finance much of the green infrastructure necessary, this requires Eskom to be a financially viable counterparty. Concessional international Phase Down Finance – compensating for asset value loss – can play a strategic role, together with domestic public finance, in achieving this.

The recent COP26 announcement of the Just Energy Transition Partnership commits an initial flow of $8.5 billion to support South Africa’s decarbonization. We believe Phase Down Finance has a critical role to play.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Energy TransitionSee all

Katie Fedosenko and Luciana Gutmann

April 15, 2024

Johnny Wood

April 11, 2024

Alexandre Raffoul and Kai Keller

April 10, 2024

Roberto Bocca

April 10, 2024

Naoko Tochibayashi and Naoko Kutty

April 10, 2024

Linda Lacina

April 5, 2024