How the new financial disclosure framework will encourage companies to protect nature

The Task Force on Nature-related Financial Disclosure (TNFD) aims to help businesses understand and disclose the impact of their activities on nature. Image: Getty Images/iStockphoto

Listen to the article

- The destruction of nature caused by business is increasingly serious and is now a major risk for companies to proceed with their economic activities.

- The Task Force on Nature-related Financial Disclosure (TNFD) aims to help businesses understand and disclose the impact of their activities on nature.

- While not mandatory, the TNFD framework is likely to become the default standard for national companies to promote the disclosure of nature-related risks, as is increasingly being seen in Japan.

The Task Force on Nature-related Financial Disclosure (TNFD), an international organization of institutional investors and corporations from around the world, has released the first international framework for corporations and financial institutions to identify and disclose the impact of their activities on nature.

As the destruction of ecosystems and loss of biodiversity have become as important global environmental issues as climate change, large corporations and financial institutions are now strongly required to understand and disclose their impacts on nature, as well as risks and opportunities throughout their supply chains.

What is the World Economic Forum doing about nature?

This will have a significant impact on corporate financing, corporate valuation, and ultimately, profits, with the background to this being the increasing risk of nature destruction caused by corporate and other activities.

Business activities such as mining of mineral resources, agricultural and livestock production, and the massive use of water resources in factories are causing increasingly serious destruction of nature, and biodiversity is disappearing at a rapid pace.

On the other hand, there are many businesses that directly depend on natural ecosystems, and the increasing destruction of nature has become a major risk for businesses, threatening their very existence.

Much of world’s GDP dependent on nature

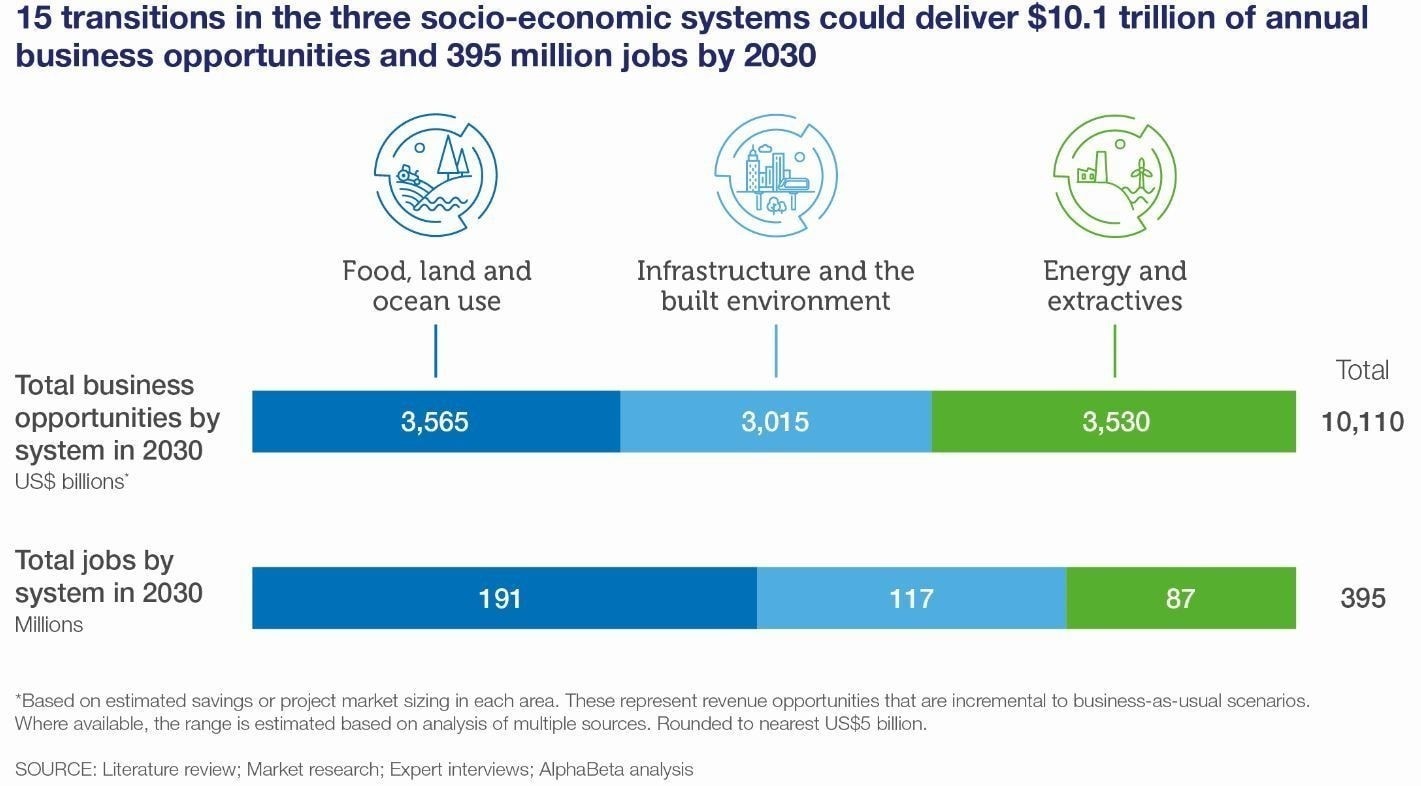

According to the Nature Risk Rising: Why the Crisis Engulfing Nature Matters report, published by the World Economic Forum in January 2020, more than half of the world’s total gross domestic product – some $44 trillion – depends on nature and its services to generate economic value.

Their businesses are exposed to the risk of nature's loss. Companies related to construction, agriculture, and food and beverage products are particularly vulnerable.

The TNFD was established in 2021 at the initiative of WWF, the United Nations Environment Programme (UNEP), and others, with the aim of promoting information disclosure in the nature sector, following the example of the attempt of the Task Force on Climate-related Financial Disclosure (TCFD) on climate change-related risk disclosure.

The objective of TNFD is to change the global flow of money from nature-destroying businesses to nature-positive activities through appropriate risk management, based on the understanding that companies themselves cannot continue to damage nature, which is the foundation of their existence.

The TNFD has undergone discussions involving experts from around the world, and has released its beta version four times, followed by the release of the final version after feedback from various sectors of society.

The importance of risk disclosure in the natural sector, which is the goal of the TNFD, was also discussed during the negotiation process for the Kunming-Montreal Global Biodiversity Framework, a new international framework for biodiversity conservation that was finalized at the 15th Conference of the Parties to the Convention on Biological Diversity in December 2022.

Although the framework did not specify mandatory disclosure, which was demanded by the European Union (EU) and other countries, due in part to opposition from the Japanese government and others, the new framework does include a target regarding the disclosure of information.

Target 15 of the new framework urges governments to encourage and enable businesses, particularly large and transnational ones and financial institutions, to "regularly monitor, assess, and transparently disclose their risks, dependencies and impacts on biodiversity, including with requirements for all large as well as transnational companies and financial institutions along their operations, supply and value chains, and portfolios”.

In this context, the TNFD framework is likely to become the default standard for national companies to promote the disclosure of nature-related risks.

The new TNFD framework, like the TCFD framework, consists of four pillars: governance, strategy, risk management, and indicators and targets.

As an approach for companies and financial institutions to identify risks, the TNFD has proposed the ‘LEAP’ approach. Specifically, companies identify where risks relevant to their business exist (Locate), diagnose their dependence and impact (Evaluate), assess the risks and opportunities (Assess), and prepare disclosures (Prepare). The most important of these is "locate", which identifies where its activities are associated with.

In addition to the direct impact of corporate activities on nature, such as development and infrastructure construction, risks in the entire supply chain, including raw material procurement, must be identified, disclosed and efforts made to reduce the impact on nature.

This is especially important for companies and financial institutions in countries like Japan, which heavily depend on imports of food, mineral resources, and other raw materials from overseas.

It is also necessary for the government to develop a legal framework to ensure that the influx of cheap but unsustainable products from abroad does not undermine the efforts of serious businesses.

Japanese firms lag behind on nature risks

Japanese companies have lagged behind European companies such as Unilever and Nestle in identifying and reducing business risks related to nature. However, as the TNFD debate has progressed, some companies have begun to take the issue seriously.

Beverage maker Kirin Holdings Co disclosed risks in July 2022 based on a prototype framework published by the TNFD. It is the first of its kind in the world, the company said. The company inspected all of its operations based on the LEAP approach and identified three priority areas that are highly dependent on and impacted by nature.

These were a vineyard for wine in Nagano, Japan, the area around a factory in Australia with significant freshwater-related risks, and a tea plantation in Sri Lanka where tea leaves are sourced. Currently, they are also in the process of setting targets.

What’s the World Economic Forum doing about climate change?

In addition, the forestry cooperative in the town of Minamisanriku, a small municipality in Miyagi Prefecture in the north-east of Japan, has participated in a TNFD pilot test with WWF Japan at an Forest Stewardship Council (FSC) internationally accredited forest, they own and reported that the information provided by FSC certified forests can be useful for companies seeking to make risk assessment under the TNFD.

Identifying and assessing nature risk is a new and unprecedented challenge for many companies and financial institutions, and they have little experience with them. It is true that implementation will be costly and that many challenges remain.

However, many companies can also see unprecedented opportunities in addressing nature positives, and the TNFD is asking for the identification of opportunities as well as natural risks.

It is imperative that many companies take the TNFD proposal seriously and make the formulation of a new framework an important stepping stone in creating a new economy and society, where nature and people can coexist and prosper together.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Climate and Nature

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Forum in FocusSee all

Gayle Markovitz

October 29, 2025