Forum Stories

Thought leadership, analysis and solutions on the world's biggest challenges.

Jump to featured themes

Global action on artificial intelligence

The Global South is reimagining artificial intelligence by prioritizing local cultural contexts over Western tech dominance.

Driving innovation through the power of AI, data, and intelligence to improve industries, economies, and societies.

More about the CentreLeading Voices

Understand the perspectives of leaders and change-makers in business, politics and civil society.

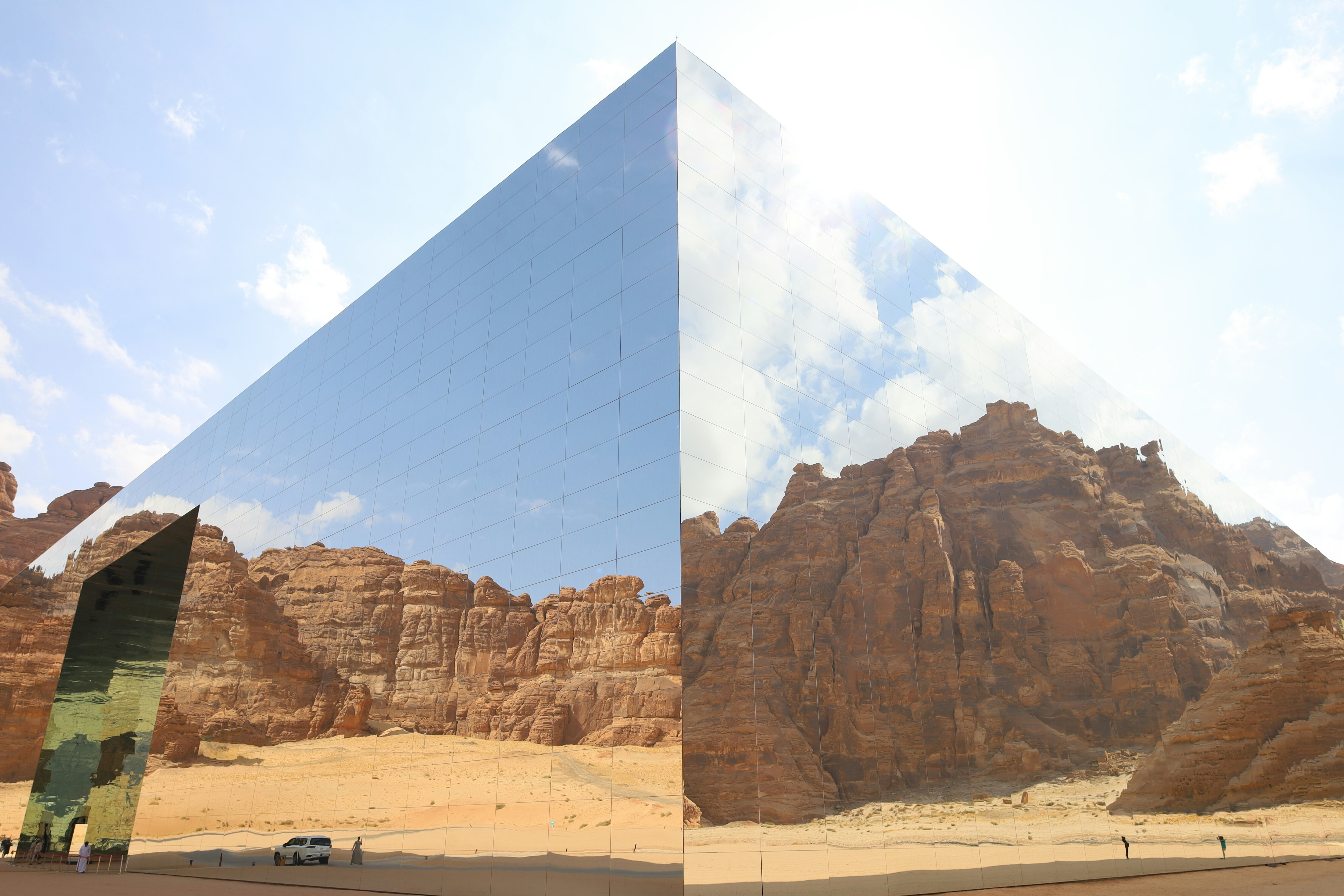

Tourism in a fragmenting world

As global mobility accelerates, the tourism sector should ensure that travel fosters cultural understanding, constructive dialogue and shared prosperity.

Providing a platform for leaders to shape inclusive, equitable economies and societies for all.

More about the CentreEditors' picks

Polarization is a major global risk that impacts other societal and economic issues. Decades ago, US civil rights leader Jesse Jackson offered a path forward to coalition building.

Helping stakeholders navigate global and regional priorities in a complex geopolitical and geo-economic landscape.

More about the CentreMore from other Centres

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

Bringing you weekly curated insights and analysis on the global issues that matter.